We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. Use the Mortgage Calculator to get an idea of what your monthly payments could. It may be wise to contact your loan officer or you can contact us for a more accurate quote on your conventional loan PMI. All examples are hypothetical and are for illustrative purposes.

This monthly payment estimate is offered for. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. Conventional loans may also require private mortgage insurance (PMI) if your down payment is less than 20. Getting the best interest rate that you can will. Mortgage rates are fixed over the life of your loan - so if your rate is 6 today at 20 yeas long, it will be 6 at 30 years too. If your interest rate was only 1 higher, your payment would increase to 1,114.34, and you would pay 201,161.76 in interest. Mortgage calculators help buyers determine what they need to put down as a down payment, how long of a term length they should choose for their new home, and the most ideal interest rate based on those variables. Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. If you buy a home with a loan for 200,000 at 4.33 percent your monthly payment on a 30-year loan would be 993.27, and you would pay 157,576.91 in interest.

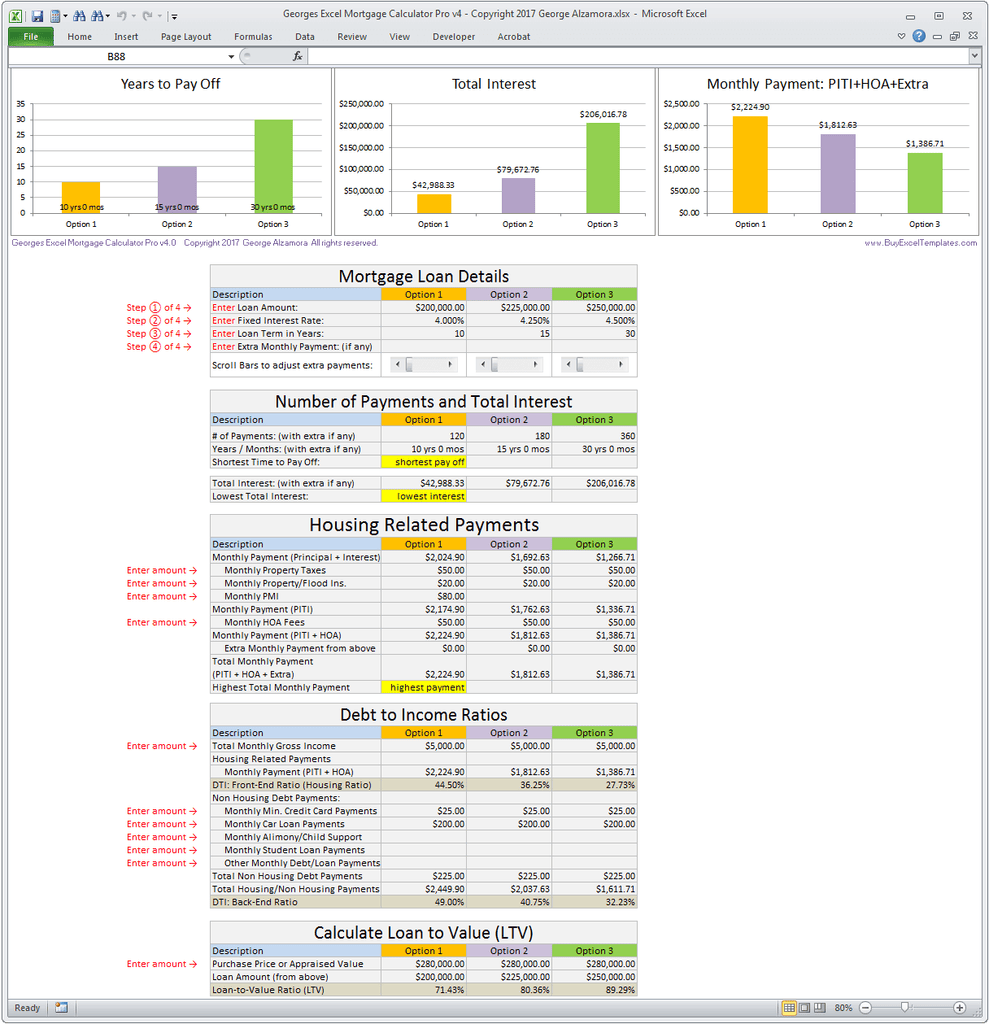

The American Institute of Certified Public Accountants A mortgage calculator will crunch the numbers for you, including interest, fees, property tax and mortgage insurance. See the impact the interest rate and term, as well as property taxes, homeowners insurance and private mortgage insurance (PMI), can have on your monthly.

0 kommentar(er)

0 kommentar(er)